Tokio Marine & Nichido Fire Insurance Co., Ltd. (TMNF) tapped SESAMm for a joint research venture to predict future stock price movements. SESAMm provided various NLP indicators, such as digital sentiment calculated for single stocks or indices (seen as an entity), as well as its experience in machine learning to work on this task.

These studies concluded with two key findings:

- Relationships exist between NLP data from news and social networking sites and investor behavior under specific circumstances. Researchers and investors can use the “digital sentiment” as an indicator of investor sentiment to anticipate price changes. They can then use this anticipation for a specific company or, more generally, any entity that can be isolated in a text (like an index).

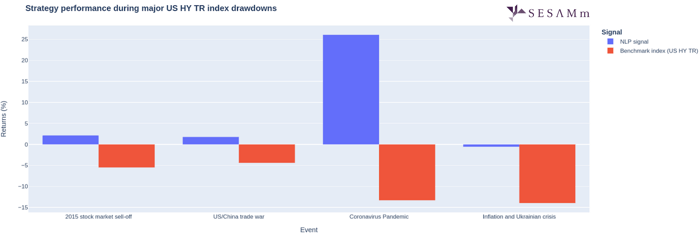

- By focusing on more stressed situations, like the 2015 market sell-off, the U.S.-China trade war, the coronavirus pandemic, and the start of the Ukrainian crisis, we could show that digital sentiment is beneficial in times of significant stress in the market. Digital sentiment more accurately reflects the stress level in these complicated situations. It, therefore, helps to predict stock price movements more accurately in these stressed cases, providing a tail hedge. It’s not biased by an excess of confidence linked to the “central banks put” for instance.

Providing safety and security since 1879

Tokio Marine Insurance Company was first established in 1879. Over the years, it has added products and services, acquired other businesses, and merged with other companies to eventually become Tokio Marine & Nichido Fire Insurance Co., Ltd. Commonly called Tokio Marine Nichido today, the company is a property and casualty insurance subsidiary of Tokio Marine Holdings, the largest non-mutual private insurance group in Japan. Its products and services provide safety and security to its clients and partners, contributing to more fulfilling lifestyles and business development.

One of the company’s philosophies is to be a good corporate citizen and fulfill its social responsibilities, including protecting the global environment, promoting human rights, creating a responsible working environment, and contributing to society and individual local communities. Recently, the Emperor of Japan awarded Tokio Marine Holdings, Inc. the Medal with Dark Blue Ribbon for donating to the Japan Student Services Organization to support students who face financial difficulty during the

COVID-19 pandemic. Individuals, corporations, or organizations are awarded the Medal with Dark Blue Ribbon for their outstanding contributions to the public.

Transforming and accepting the challenge to grow

According to TMNF, “The business environment surrounding the insurance industry is changing at a faster pace than ever due to changes in demographics, advances in technologies, such as autonomous driving and AI, and longer-term trends, such as the intensification and frequent occurrence of natural disasters, as well as further progress in digitalization due to the COVID-19 pandemic.”

“The business environment surrounding the insurance industry is changing at a faster pace than ever…”

“While these changes in the business environment pose a threat, we consider them to be excellent opportunities for transformation and the creation of new value.” So they’ve adopted the concept, “Transformation (“X”) and Challenge to Growth 2023: Aiming to be the company most chosen for quality and its passion.” Ultimately, it strives to support customers and local communities in times of need while contributing to social responsibility. Five social issues that it will prioritize are:

- Global climate change and the increase in natural disasters

- The increased burden of long-term care and healthcare due to the aging of society and advances in medical technology

- Technological innovation and its effects on the environment

- Symbiotic society and responding to the novel coronavirus

- Industrial infrastructure and how it supports economic growth and innovation

Leveraging a partner with the right technology

To secure and protect its clients’ assets while elevating social issues, Tokio Marine Nichido sought out an edge in the stock market. Under these circumstances, it was fortunate that TMNF discovered SESAMm in 2020 through the Plug and Play Japan program, a platform with an event that connects Japan to markets abroad. SESAMm had presented its NLP alternative data solution, TextReveal®, to which TMNF considered the platform for access to alternative data and sought collaboration with the SESAMm team for a research project.

“SESAMm has the technology to extract sentiment from news data with a neural network.”

– Tokio Marine & Nichido Fire Insurance Co. Ltd representative

Extracting relations between NLP data and the financial market

In 2021, Tokio Marine Nichido Insurance began collaborating with SESAMm to develop an AI analytics model for alternative data. It models the effect of news and social networking data on investor behavior for stock and bond markets. In other words, it structures text information into knowledge usable by TMNF.

Monitor risks and topics

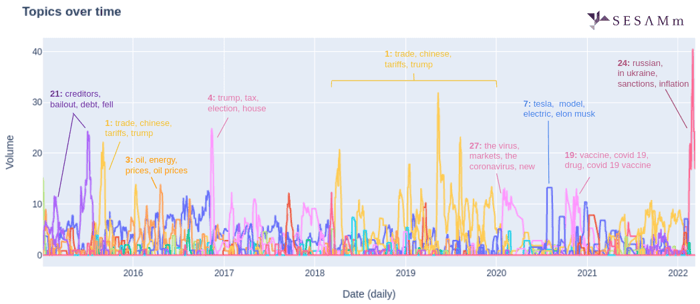

NLP data can improve the understanding of the market’s behavior by exhibiting the most important topics over time, with a direct indication of the importance of the topics through the text volume (Figure 1).

Figure 1: Automatic detection of the main topics in the U.S. market since 2015, thanks to topic modeling.

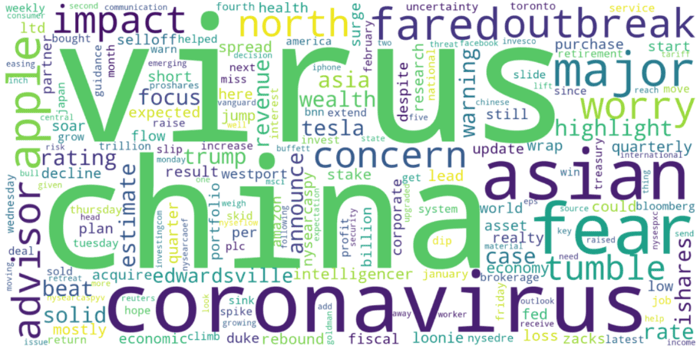

Researchers can also use it to focus on a specific topic or a certain period. For instance, a short analysis of the most frequent keywords in the press, which preceded the market fall during the COVID-19 pandemic, showed the significant predominance of pandemic-related terms (Figure 2).

Figure 2: Most frequent keywords in English S&P 500-related articles between 17 Jan. 2020 and 19 Feb. 2020.

Focusing on the equity market

NLP tools provide specific data, like sentiment, to get more detailed information at the company level and for many underlyings. Indicators for equity indices, for instance, can be calculated and provide a clean sentiment to monitor markets.

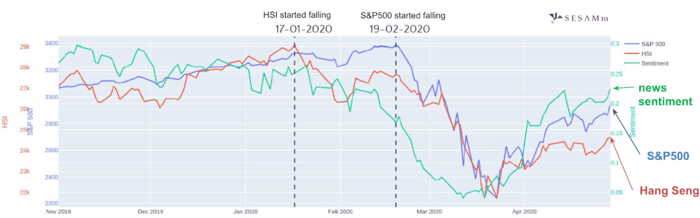

In many situations of stress over recent years, such sentiment proved to be an early indicator of the market’s future degradation. For example, there was a time lag of as long as a month between the time COVID-19 became the main news focus and the time it affected the U.S. stock market. By using SESAMm’s technology to analyze news data during this period, the team found that the U.S. digital sentiment had already deteriorated sharply before stock prices reacted (Figure 3).

Figure 3: In 2020, U.S. news sentiment falls ahead of the stock market in response to COVID-19 concerns.

This sentiment deterioration occurred because of the fear of the coronavirus’s spread’s effect on the global economy (see Figure 2). Even with an all-time high S&P 500, U.S. investors didn’t initially consider this risk. In comparison, HSI companies were closer to the coronavirus spread risk. So as a result, HSI investors reacted ahead of their U.S. counterparts. In other words, by using natural language data, it was possible to capture a risk overlooked by U.S. investors but related in the publicly available texts and take action ahead of the market deleveraging.

Generalizing the results to the credit market

Tokio Marine Nichido also expanded the scope of the research to U.S. high-yield bonds index trade. In the credit market, a high yield has a high beta, which makes its risk comparable to the equity market.

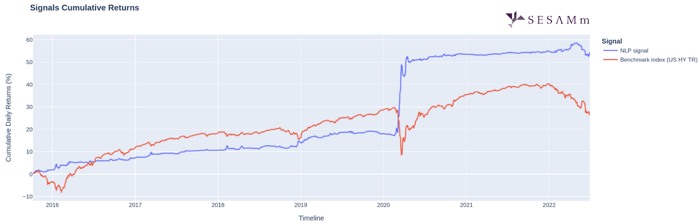

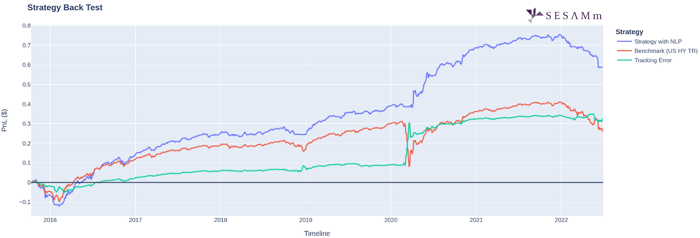

Research shows that, on a risk-adjusted basis, the NLP-data-built signal has a positive and consistent performance through the timeline compared to the U.S. HY T.R. index benchmark (Figure 4). Its performance has a low correlation with the index (Figure 5), so the sentiment is diversifying. It not only acts as a diversifier but delivers higher returns than the benchmark when the U.S. High Yield market sold off (Figure 6). As such, the NLP signal diversifies, hedges, and protects against adverse periods. It provides a mechanical pick-up in risk-adjusted return when running alongside traditional strategy.

Figure 4: An NLP-informed signal has positive and consistent performance. The volatility level is the same for both curves.

|

Figure 5: Performance correlation |

||

|

All timeline (Without COVID-19 period) |

NLP Signal |

Benchmark (U.S. HY TR) |

|

NLP Signal |

1 |

-0,42 (0,13) |

|

Benchmark (U.S. HY TR) |

-0,42 (0,13) |

1 |

Figure 5: The NLP signal and market daily performances are de-correlated.

Figure 6: The NLP signal delivers higher performance during adverse periods.

The NLP signal outperforms the index in realistic backtest conditions, including long allocation only, turnover constraints, and trading fees (Figure 7). The quantitative model integrates some macro indicators, but the previous NLP signal induces the main source of outperformance and risk mitigation.

Figure 7: An NLP-informed high-yield strategy outperforms the U.S. high-yield total return index.

TMNF is also applying the research to estimate the Fed’s stance—hawkish or dovish—using natural language data, too. It hypothesizes that the market will be focused on the Fed’s stance on interest rate hikes in the next few years.

“The model developed in collaboration with SESAMm is simple in structure, yet, it’s an orthodox and robust model that uses valid data as input.”

Summarizing the collaboration

In developing models, Tokio Marine Nichido believes it’s essential to consider “what data to consider” and to keep it simple. And TMNF achieved these tenets. The model developed in collaboration with SESAMm is simple in structure, yet, it’s an orthodox and robust model that uses valid data as input which is preferable to a risky over-fitting by increasing complexity.

Get in touch with SESAMm

To learn more about Tokio Marine Nichido’s case study or to request a TextReveal demo, reach out to us.

Note: The contents of this document do not constitute an offer or solicitation to buy services or shares in any fund. The information in this document does not constitute investment advice or an offer to invest or to provide management services and is subject to correction, completion, and amendment. Past performance is not indicative of future results.