The macroeconomic environment is moving quickly—inflationary pressures, war in Europe, political instability, and plenty of other topics to make a trader's head spin. While there’s an abundance of structured macro data, it's much more difficult to extract value from unstructured text on the web.

However, with the right partner and the right tools, it doesn't need to be difficult to rein in this complexity. But more on that later.

More data, more problems

We're obviously in the information age; we have more data within reach than ever before. And you'd think that more data would make it easier to find consistent relationships between the macro economy and price returns. The hard truth is that it doesn't.

Of course, you have access to comprehensive historical information, but developing economically intuitive and worthwhile systematic strategies from historical data alone is challenging. Despite having this data, it could still be incomplete, missing that bit of nuance for a theme you're examining.

Nowcasting for more complete, current data

Nowcasting—a contraction of the words now and forecasting—is the prediction of the present and the near future using data from the recent past as an economic indicator. Nowcasting models can be applied in real time as a proxy for official measures, such as monitoring the state of the economy, themes, or sectors: food, transportation, energy, and so on.

For example, you could look into what's being said about supply chain disruption for semiconductors. How is the topic trending across industries or the broader public? And how positively or negatively is that topic perceived over time? This information helps give financial data context and direction, a way to predict what happens next.

So where do you turn to for reliable, timely nowcasting data?

Nowcast-enhancing platform

At SESAMm, we have a flexible, adaptable, and modular platform to nowcast pretty much any macroeconomic theme: inflation, supply chains, unemployment, and everything in between. If you can gauge it, we can find data on it.

How do we do this? Our natural language processing (NLP) platform makes sense of all available news, articles, and forums on the web. Currently, there are more than 20 billion articles in our data lake, and it's growing by millions daily. And because we update our data lake multiple times a day, you can read nowcast macroeconomic indicators in near real time.

This flexible approach to building themes goes way beyond off-the-shelf sentiment feeds, and you can adapt to new, emerging factors on the fly.

Use case: inflation insights

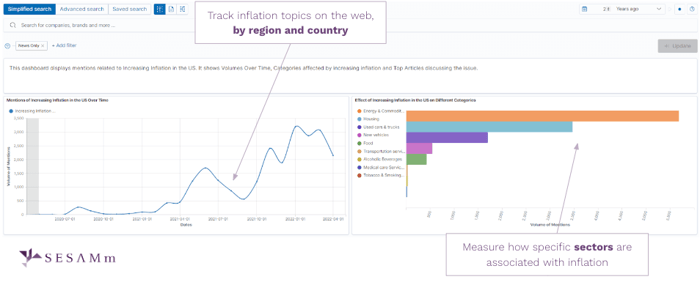

With the TextReveal® API and Dashboards, you can generate custom proprietary inflation requests—or pull existing queries by country and sector—and use this data in your nowcasting models (Figure 1).

Figure 1: TextReveal's dashboard highlights inflation topics on the web and associated sectors.

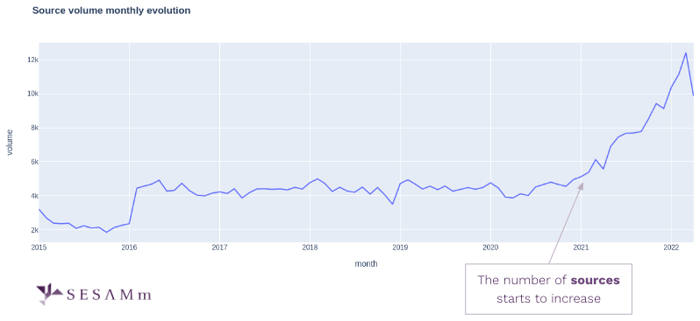

In this example extracted from our API (Figure 2), the number of sources mentioning inflation is relatively stable until 2021, when it starts to increase rapidly, in anticipation of actual inflation readings.

Figure 2: The number of sources mentioning inflation increase in early 2021.

As you can see, you can track a topic and map it to various segments, creating a signal that accurately follows that theme over time. But that's not all. Macro teams can inject their expertise into building these queries, too. So if they have specific ideas on keywords and themes to capture—for example, inflation in Brazil—they have complete control over them.

Ultimately, you can break down the data by volume, sentiment, sector, language, or country. Do you want to know what the Japanese market makes of rising inflation in the U.S.? With SESAMm's platform, you can slice the data in different ways to find out.

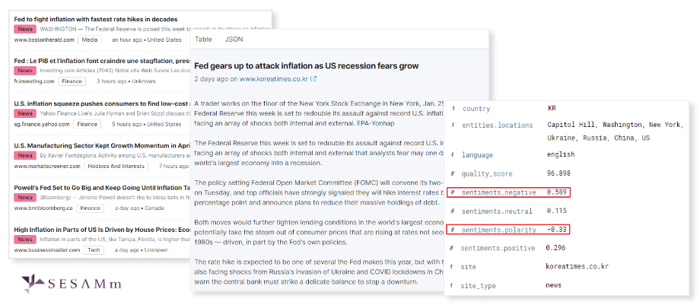

Results with transparency

All that inform the results of your queries are available for scrutiny. Say you want to understand why a topic or theme is trending one way or the other, or maybe the sentiment isn't what you expect. You can drill down to the source articles to see why (figure 3).

Figure 3: An example of source articles affecting sentiment score.

Use Case: predictive signals for macro factors and commodities

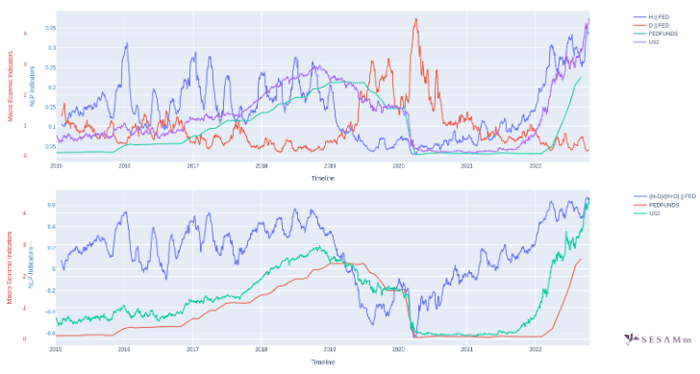

We worked with a client as part of an asset allocation strategy to build indicators reflecting the tone of the Fed fund rate to see what we could predict based on the indicators.

[figure 4]

Figure 4: The Fed tone indicator successfully anticipated the major changes in the fed rates—a reduction during the COVID-19 crisis and a rise in 2022.

In Figure 4, the language we uncover becomes increasingly dovish, as indicated by the blue line, the aggregate of the hawkish and dovish indicators. It's proceeded by the fall in interest rates, the start of covid, and the recent inflationary period. Then, the indicators spike way before interest rates move up. Of course, it isn't the only factor, and it's not 100% predictive, but it does reflect future movements. Inflation is at an eight-year high right now, so it's indicative of continuing inflation returns and continuing rising interest rates.

Nowcasting and forecasting with TextReveal

With TextReveal, you can nowcast any macro theme by building expert-driven queries and predictive forecasting signals to get insights into volume, sentiment, and more.

If you want to find data relationships that accurately reflect economic trends and macro themes to what's happening online in near real time with a high degree of control, reach out for a demo.