SESAMm Empowers ESG Professionals to Make Informed Decisions

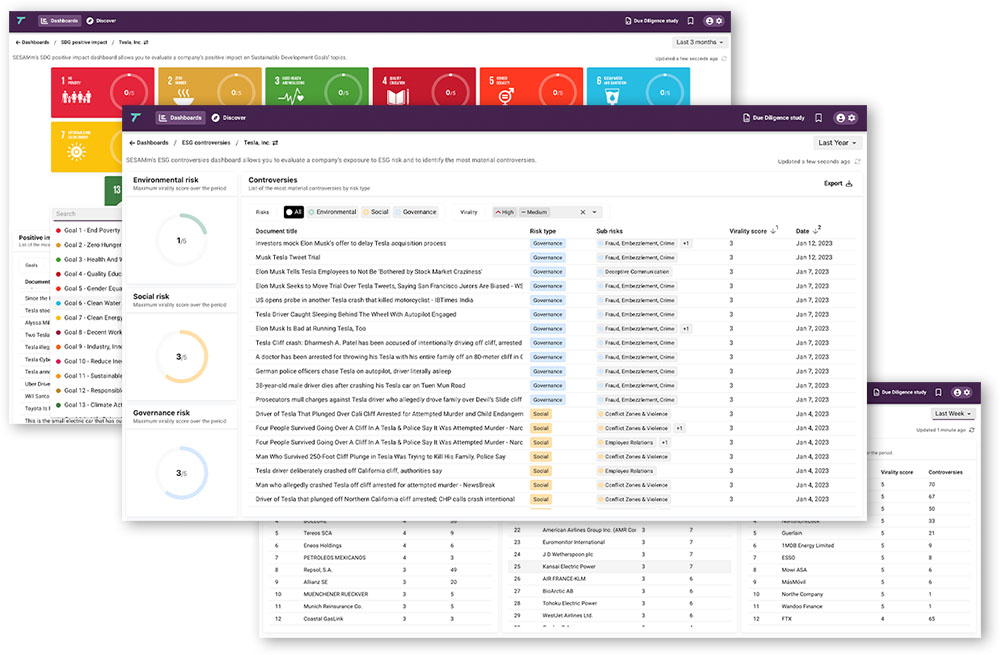

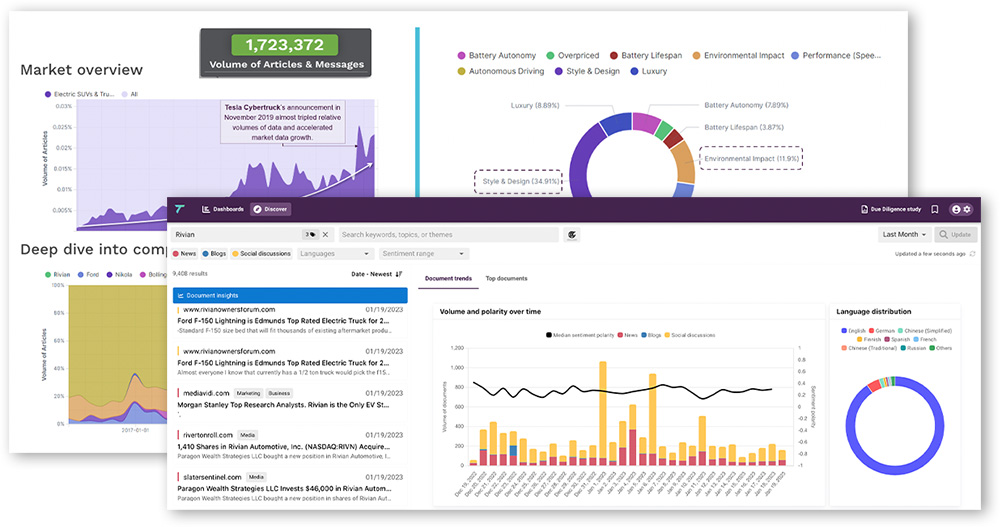

TextReveal® analyzes billions of articles to uncover ESG controversies in virtually any public and private company so you can make timely decisions.

Get ESG and SDG transparent, real-time insights on your organization, portfolio companies, and suppliers, among others. TextReveal enables you to monitor and get timely alerts on potential ESG controversies and to comply with regulatory requirements.

Risk Assessment

SESAMm's ESG Risk Assessment, powered by TextReveal®, transforms due diligence for investors. Using AI to analyze over 25 billion documents, it uncovers hidden risks and ESG controversies, delivering accurate, instant reports on millions of companies. These insights are essential for enhancing informed decision-making in both public and private markets.

Global ESG Coverage

Access data on over 5 million companies, both public and private, worldwide. Our comprehensive coverage allows financial institutions to effectively monitor ESG performance and controversies

Real-time ESG Monitoring

Stay informed with real-time ESG alerts. Our AI scans millions of sources, identifying risks and opportunities in your portfolio or target companies instantly.

Diverse Data for In-Depth ESG Analysis

SESAMm taps into over 4 million sources, offering insights beyond standard reports. Our data provides an outside-in, holistic view of a company's sustainability, aiding informed ESG decisions.

14-year-old proprietary data lake. TextReveal processes text from financial and non-financial news sites, social networks, blogs, forums, and specialist websites, adding more than 10 million new documents daily,

25B

25B

25B articles + 10M added daily

Including Chinese, Japanese, and Eastern European languages among others

100+

100+

100+ languages

We cover virtually any public or private company, from mega caps to small private companies

5M

5M

5 million public and private companies

Including: News, Blogs and Forums, Message boards, Product reviews, corporations, trading and investment, social data and earning calls

4M

4M

4 million public and premium sources

SESAMm’s TextReveal has the most comprehensive coverage in the industry

Multiple delivery mechanisms that adapt to your workflows:

- Live dashboards via desktop app

- Email alerts on ESG controversies and SDG positive impact events

- Access to TextReveal’s data lake via API & flat file delivery

- CRM integration and portfolio management system integration

Transparent

Gain access to article-level data and premium content to explain major ESG controversies and risk events.

Machine learning-generated, humanly enhanced

Data analyzed and synthesized by our AI algorithms and enhanced by our manual annotation step

Timely insights

Review, aggregate, and score data from millions of news articles, blogs, and social media discussions, daily

.png?width=1600&height=1524&name=Data%20lake%20SESAMm%202024%20(1).png)

TextReveal: The powerful engine behind SESAMm’s solutions

SESAMm is a leader in multilingual AI technologies. Our sentiment analysis algorithms rely on deep-learning techniques; we have the expertise to ensure no biases exist in the indicators, from annotation campaigns to algorithm training for unbalanced datasets. We also leverage advanced NER (named entity recognition) and disambiguation techniques to detect relevant companies in multiple languages properly.

Latest Insights

Blog | Video

Webinar Replay: ESG Ratings in 2025: Emerging Trends and Evolving Standards

Read More »“Expanding our partnership with SESAMm builds on Carlyle’s continued leadership in leveraging big data, data science, advanced analytics, and machine learning to further differentiate our investment platform. We look forward to continuing to work with SESAMm to provide additive insights for our deal sourcing, diligence, and to help guide our portfolio companies in value creation.”

— Matt Anderson, Chief Digital Officer and Managing Director

“Since we started working with SESAMm a few years ago, we've been impressed by their broad coverage in private and public companies in our core markets in CEE," said David Eschwé, Head of Group Advanced Analytics in RBI. "Our partnership has been a great success. Thanks to SESAMm, we can now answer business-relevant questions within days, including those related to the critical topic of ESG.”

— David Eschwé, Head of Group Advanced Analytics

“Using SESAMm’s text analysis, we took a deep dive into investments with an ESG lens. SESAMm’s platform helped us catch potential issues early and keep track of controversies. They offered a wide range of ESG indicators, backing our sustainable investment focus with more depth of content. The platform also highlighted the main ESG events for the companies we were investigating and their competitors. Even with a tight deal timeline, SESAMm provided insights when needed. It added an additional perspective to our risk checks and ongoing monitoring. In short, SESAMm made our ESG investment considerations both sharper and quicker.”

—

“Asset Management One has been working with SESAMm since late 2019 to integrate AI, and their work and support has been very helpful. They have conducted a credit prediction project with us, and we are now using their data science tool as well as their alternative data, which brings a lot of value to our credit fund selection process.”

— Asset Management One

“SESAMm’s solution helps us to provide opinions on controversies affecting the companies we follow positively and negatively. Previously, it was only possible through human intervention, which meant a much more limited capacity and much higher cost than AI-powered tools, making it very difficult for our clients to access this information.”

— Xavier Leroy - Member of the executive committee - Head of advisory services